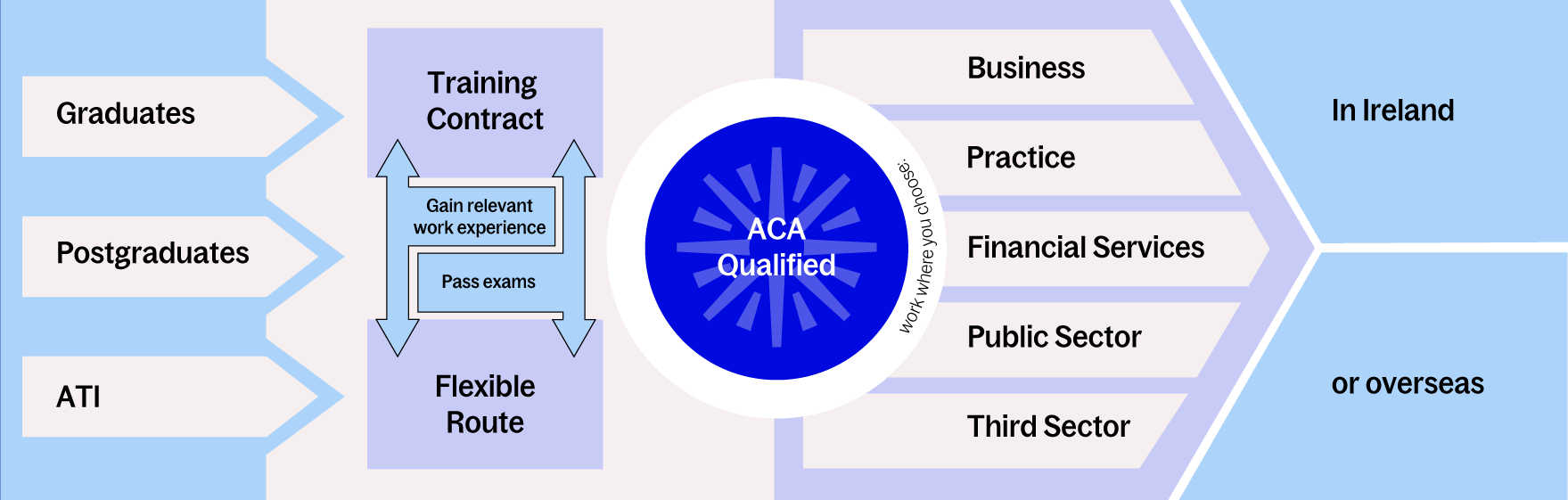

Chartered Accountancy allows members to move freely and successfully across a diverse range of sectors and roles. There are two main career paths for the profession:

Working in Business

Chartered Accountants play a vital role in Irish and international business. Chartered Accountants typically work in roles such as business analyst, management accountant, financial controller, corporate treasurer, tax advisor or internal auditor. Chartered Accountants are involved at the highest level in virtually every sector from Healthcare to Technology, Finance to Manufacturing.

Working in Practice

Chartered Accountants working in practice provide professional financial services to business. Auditing, financial analysis, risk management and advising on information systems and financial structures are the primary services provided by practising firms.

Chartered Accountants act as consultants on business strategy, process re-engineering, human resources, production and financial control and much more.

Working in Financial Services

Chartered Accountants enjoy rewarding careers in the Financial Services sector. Chartered Accountants working in this arena advise on risk management, on raising finance, on the optimum use of assets and on the choice of specialised financial instruments. It is challenging work - Chartered Accountants are constantly alert to new market forces and changing market trends - but the monetary rewards reflect this responsibility.

The Chartered Accountancy professional qualification can be obtained through a number of routes and is open to graduates, non-graduates accounting technicians and school leavers.

Like any profession, the path to qualification is not easy and requires a high level of dedication. The rewards that qualified Irish Chartered Accountants' generate in terms of career satisfaction, salaries and advancement, are remarkable.

The first decision you'll need to make will be whether to train under a training contract with a registered training organisation (RTO) this is often a large accountancy practice. Or the flexible option, independent of a training contract in practice, industry, financial services, public sector etc.

Becoming a Chartered Accountant involves a combination of academic training and professional experience. The majority of students generate the required level of experience working full time while studying part time.

What is the Training Contract?

A training contract is agreed with the employer and will outline the length of you will work with the practice (for graduates, the duration of a contract is three-and-a-half years; for recognised masters or postgraduates, three years; Accounting Technicians, four years). The employer pays tuition fees and assigns a mentor and provides study leave when needed to support students to ultimately qualify.

What is the Flexible Option?

The flexible option is another way to qualify independently of a training contract. It delivers the same standard of education as the traditional route via a training contract, but the education and experience elements do not have to run parallel.

As a student following the flexible option, you will sit the same exams as other students and will have to meet the same experience requirements that pertain to others.

Click on the image below to read up to date salary information: